Well-structured quotes based on customer behavior will help control variable costs and boost cash flow and earnings.

A company often calculates its earnings before interest, taxes, depreciation and amortization (EBITDA) to measure financial health. Stripping out “nonoperational” expenses provides a clearer picture of your company’s ability to generate cash flow for its owners and for judging operational performance.

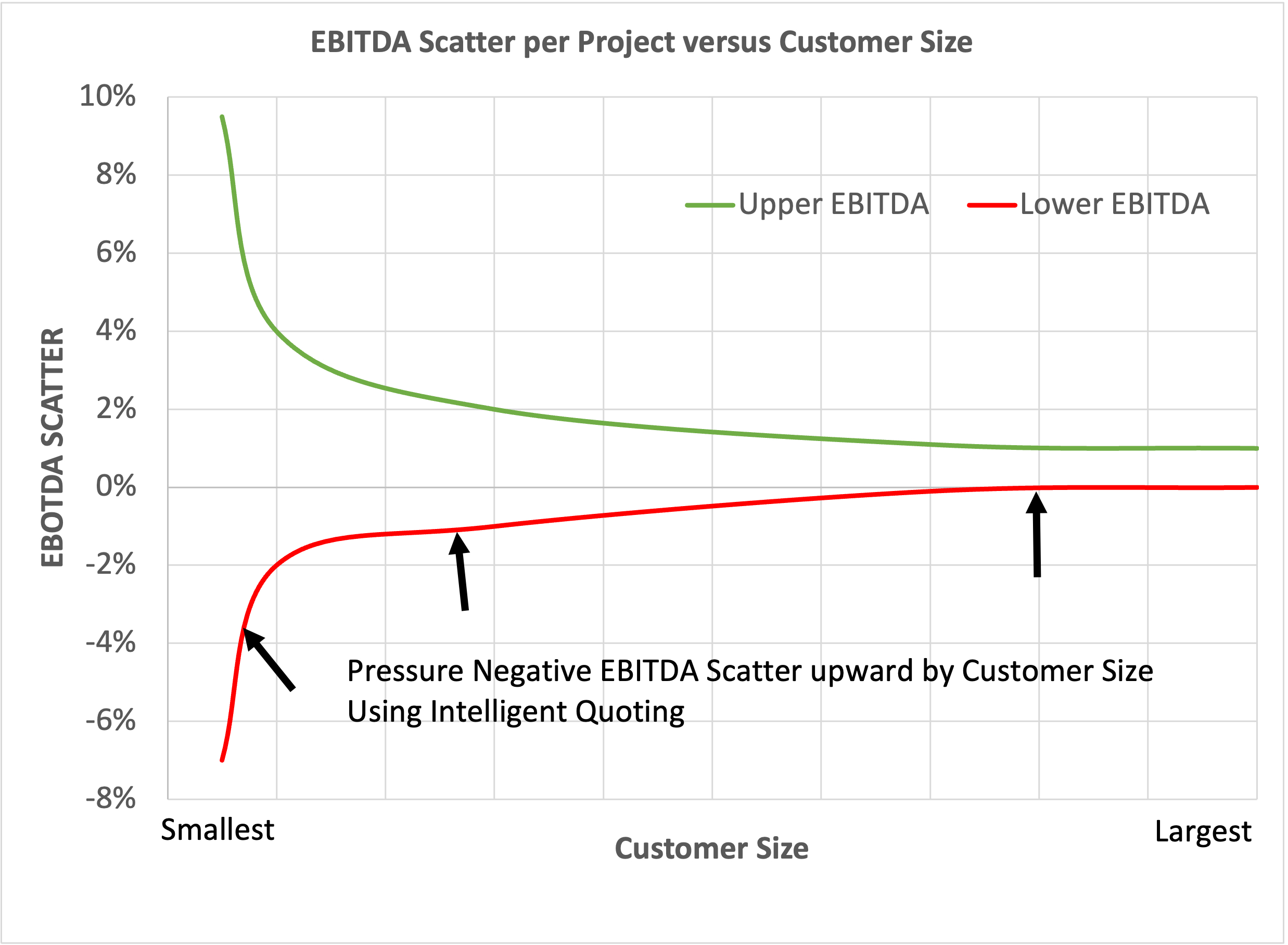

The primary tool we have in our industry to generate cash flow is the quote. If your price is too high, your competition will get the business. If the price is too low, you will be the next contestant in the “race to the bottom,” where the winner is the loser. Quotation guesswork leads to erratic EBITDA, which is what I refer to as EBITDA scatter. So, how do we price competitively and control EBITDA?

Reduce “EBITDA scatter”

Below is a typical representation of EBITDA scatter. A producer’s earnings uncertainty is the highest for small customers, as these quotes are individually insignificant and too small to attract supervision. The scatter is reduced for midsized customers, whose quotes sometimes get managerial inspection. Managers always carefully dissect and correct quotes for the largest of customers who are too big to risk a major misfire.

The best way to control EBITDA is through reducing scatter. Increasing the upper EBITDA curve is difficult, thus efforts should be concentrated on reducing the negative effect of the lower EBITDA curve.

Of course, we must understand and control the costs we can, such as materials, labor, fixed operations, etc. The difficulty lies in managing the variable costs, some of which we control but most of which are directly influenced by customer behavior. Assuming we do our part and monitor elements like “time in yard after loading,” we must then account for the seemingly impossible: Customer behavior with our variable resources, like trucks, drivers and cash. (Slow payments incur interest expenses for the producer.)

Fortunately, with each project, order and ticket we fulfill for a given customer, we can learn their behavior, especially if we track by work type and crew. Their behavior in using variable resources can be measured and accommodated in the quotation process.

Consider the elements comprising variable, material and fixed costs

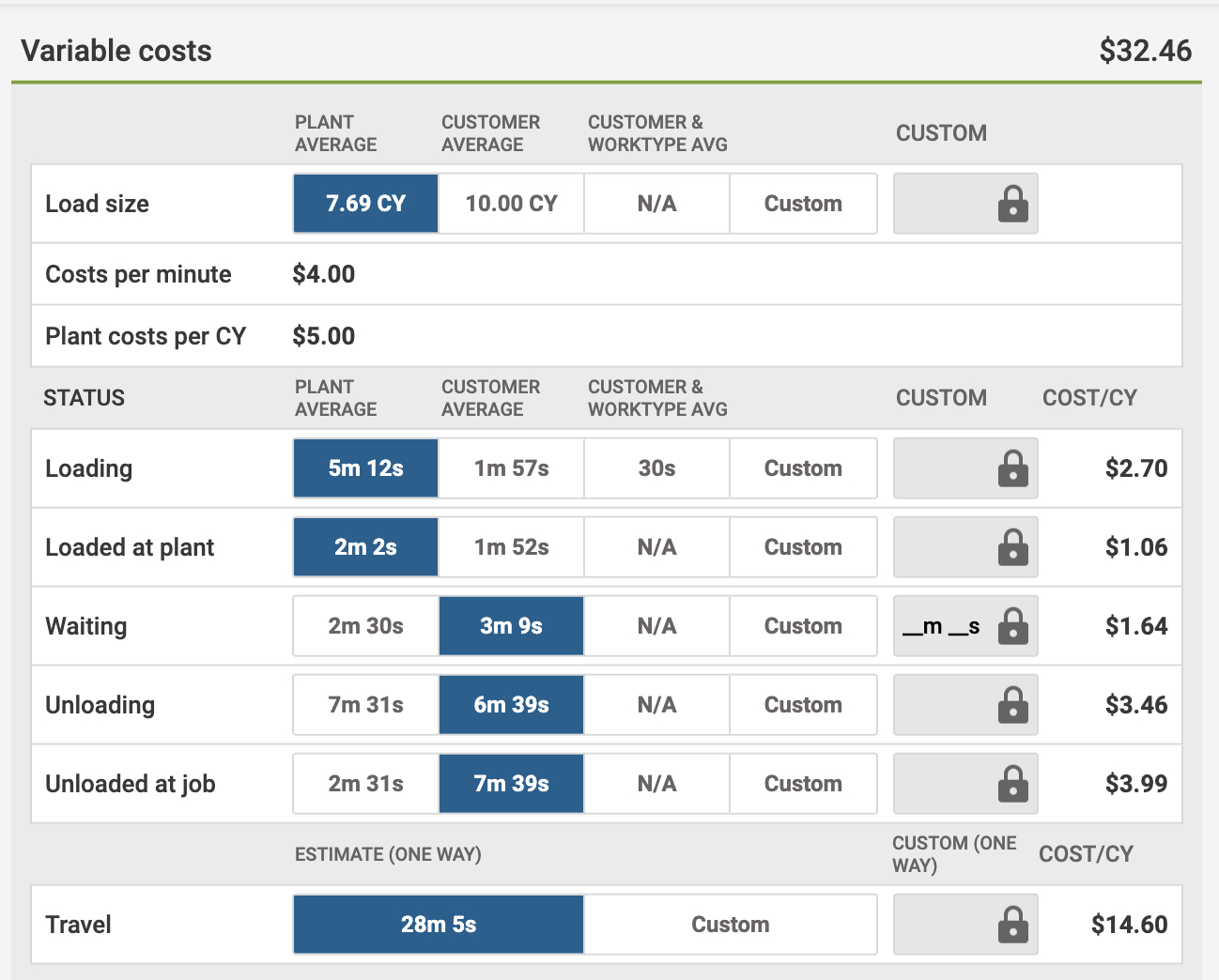

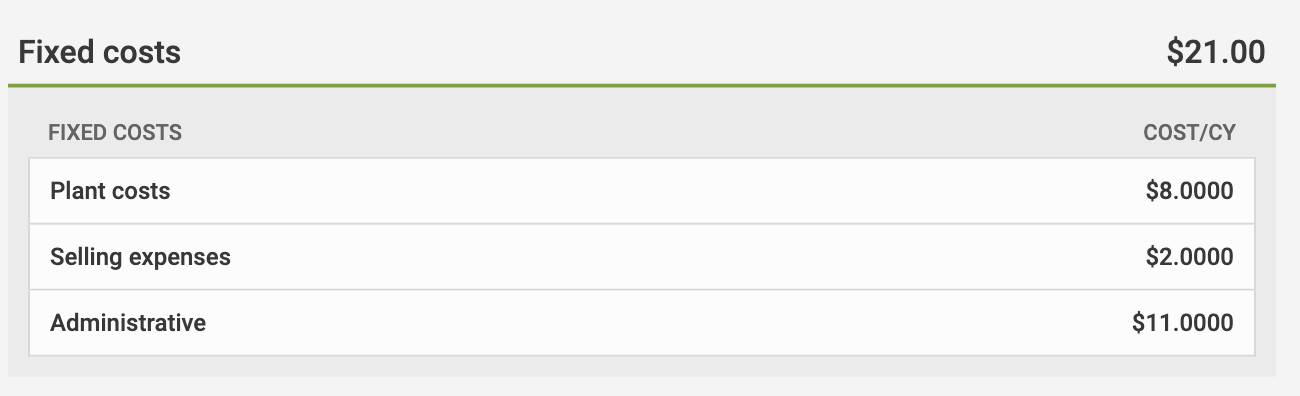

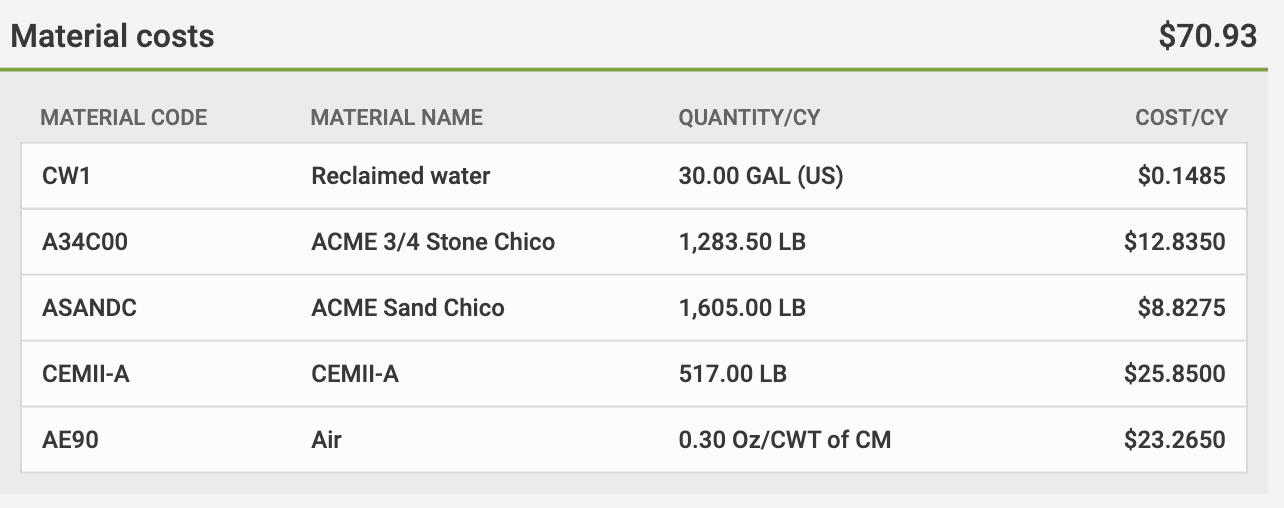

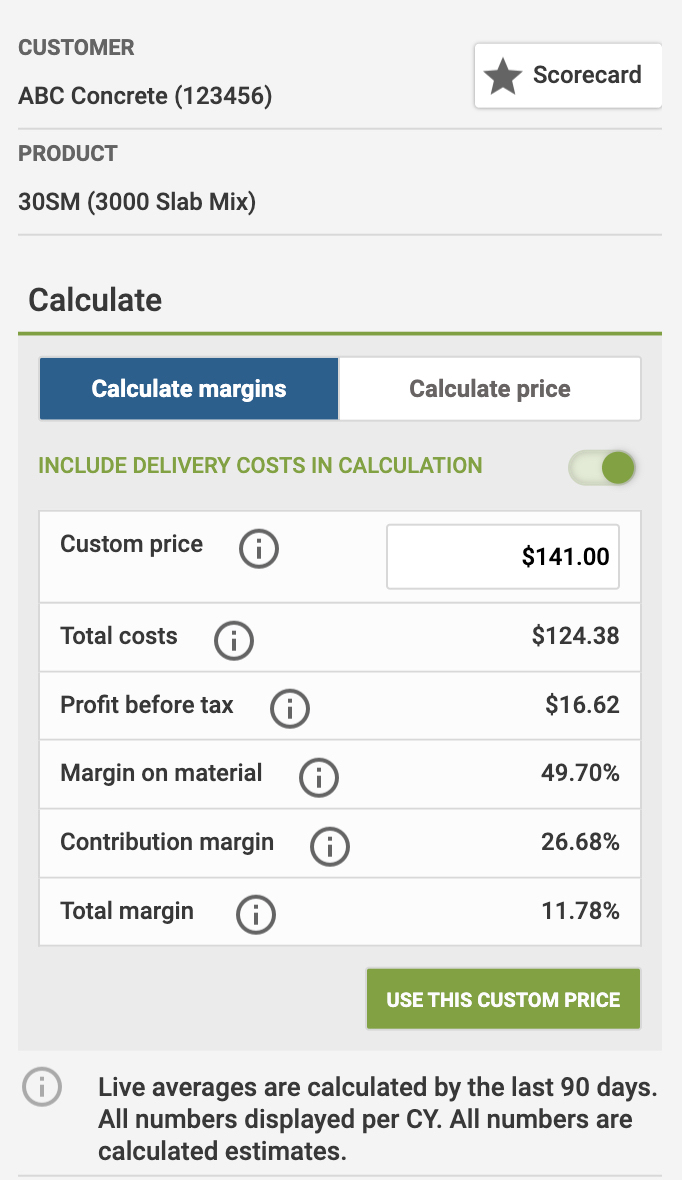

Below are sample templates with the type of data drawn from the producer knowledge base, including customer behavior, needed to drive more accurate cost estimations. The first template covers variable costs, mainly from trucking. The second covers material costs, given the specific plant and mixes. The third covers fixed costs. As a whole, these three cost categories lead to an accurate cost estimate on which to build the desired percent margin or dollar value profit. (All template images are taken from BCMI’s Material Pro CRM system.)

Note that if the customer’s work type is tracked, much more accurate variable cost usage for “waiting,” “unloading” and “unloaded at job” can be established. Our industry often struggles with accurate denotation of work type. It takes a companywide effort to control EBITDA scatter, and encouraging the order-taking staff to gather work-type information is critical.

Fixed costs typically make up the smallest portion of the EBITDA puzzle. Nonetheless, it is important to benchmark against similar producers to ensure you are running as efficiently as practical. Quotes are often won or lost on a few dollars per cubic yard.

Material costs are usually very similar across Material costs are usually very similar across all competing producers. Vertically integrated producers with control over aggregate, cement and ready mix can drive economies with aggregate and cement supplies, but just as often, it hurts. Vertically integrated suppliers are notorious for charging their captive ready mixed producers higher prices than they charge ready mixed competitors.

Controlling variable costs is key

Producers work very hard to control fixed and material costs. This results in generally similar fixed and material costs for producers in a similar market. The win lies in properly understanding and controlling variable costs. Producers who harvest a wealth of data from prior customer behavior have a huge advantage in understanding the true cost of doing business.

Detailing all the cost components based on the actual usage patterns and customer scorecard allows accurate quoting. The customer’s specific scorecard (not shown in this article) allows the sales staff to evaluate all aspects of a given customer, including how well they pay and the rolling expense of disputes. If a producer loses money on a job, it should be by conscious choice and not sloppy quoting.

Win-win for producers and their customers

While seeming counterintuitive, the customer also wins with a more structured quotation process. The inefficient use of the producer’s variable resources is inevitably a result of the inefficient use of the finisher’s resources. Helping the customer plug profit holes helps everyone.

The bottom line is that EBITDA scatter can be mitigated by instilling a controlled quotation process using the trove of customer behavior knowledge throughout the entire company. Instead of incentivizing sales staff to get volume at all costs, a structured process that demands minimum margins without managerial approval can be secured. Ultimately, deciding to make or lose money on any job must be yours.

PRIORITY ACCOUNTS, PRIORITIZED SERVICE

A clarification on incorrectly labeled X and Y axes in the November Technology Trends “Total Volume versus Customers” chart … In last month’s Customer Segmentation Service Levels column, Craig Yeack encourages concrete producers to identify accounts by top, middle and bottom segments, and customize service accordingly. In a typical ready mixed concrete business, total delivery volume breaks down at about a 70/25/5 percent level. — Don Marsh, editor

Craig Yeack has held leadership positions with both construction materials producers and software providers. He is co-founder of BCMI Corp. (the Bulk Construction Materials Initiative), which is dedicated to reinventing the construction materials business with modern mobile and cloud-based tools. His Tech Talk column—named best column by the Construction Media Alliance in 2018—focuses on concise, actionable ideas to improve financial performance for ready-mix producers. He can be reached at [email protected].