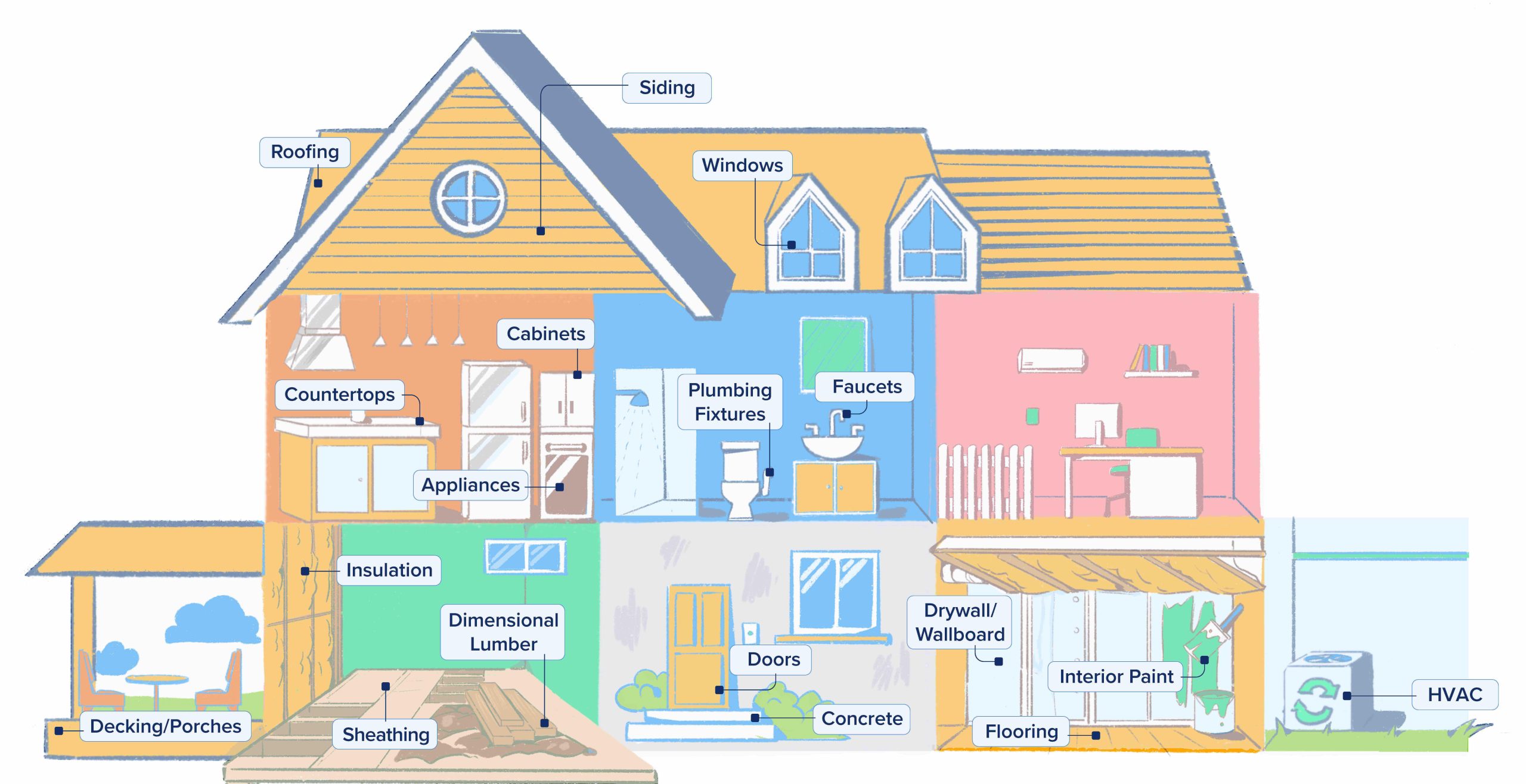

An industry-first data offering from John Burns Research & Consulting, Irvine, Calif. and Home Innovation Research Labs, Bethesda, Md. tracks current and historical U.S. residential installed volumes (final demand) for concrete and 17 other material or product categories. The Building Products Demand Meter, profiled at www.jbrec.com, measures volumes and year-over-year growth rates in new building, repair and remodel segments back to 2000. Among inaugural Demand Meter takeaways:

- Building product volumes are showing mostly negative growth trends for 2023. Single-digit declines are expected for 17 of the 18 building product categories tracked in 2023.

- Weakness is particularly evident in the new construction segment, where installed volumes are anticipated to decline by double digits in 10 of the 18 categories.

- Installed volumes for repair and remodel show more resilience this year, with only eight out of the 18 categories declining in 2023.

“The building products industry has been asking for better data to make more informed decisions,” says John Burns Senior Vice President of Building Products Research Matt Saunders. “This groundbreaking new product addresses this need, combining our expertise in forecasting and analysis with Home Innovation’s industry leading survey research. The Building Products Demand Meter provides market size and growth estimates at the category level for both new construction and repair and remodeling end markets.”

Scheduled for quarterly updates, Demand Meter data is grounded in more than two decades of Annual Builder Practices and Consumer Practices surveys by Home Innovation, an independent National Association of Home Builders subsidiary. “The Building Products Demand Meter combines the best of our longstanding survey research, JBREC’s best-in-class forecasting expertise, and our deep combined knowledge of home building and remodeling,” affirms Home Innovation Director of Market Research Ed Hudson.

TARGET CATEGORIES

INSULATION RECYCLING VOLUME: 1.7 MILLION TONS

NAIMA members in the U.S. and Canada logged 2.66 billion pounds of recycled glass and nearly 700 million pounds of recycled slag in their 2022 output of fiber glass and rock or wool thermal and acoustical products for residential, commercial and industrial applications. Since the industry’s recycling program began in 1992, NAIMA member plants have diverted 100 billion-plus pounds from the waste stream.

“Our industry continues to demonstrate its commitment to using recycled materials,” says NAIMA CEO Curt Rich. “With increased focus on whole building decarbonization, insulation products will be a critical component of that activity. Sourcing recycled materials is one way we can decrease our environmental impact while producing materials that ultimately lower building emissions.” — NAIMA, Alexandria, Va., www.insulationinstitue.org.