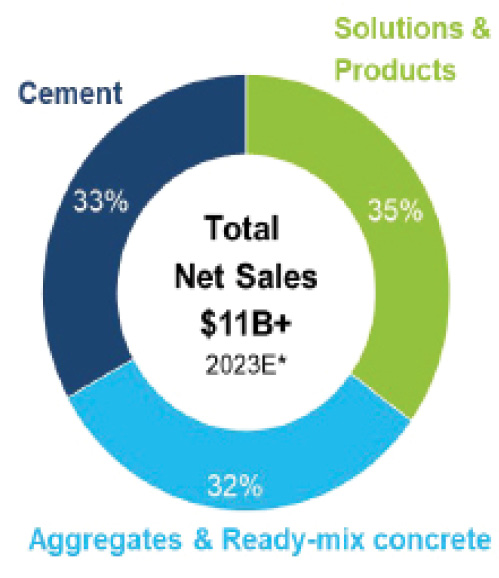

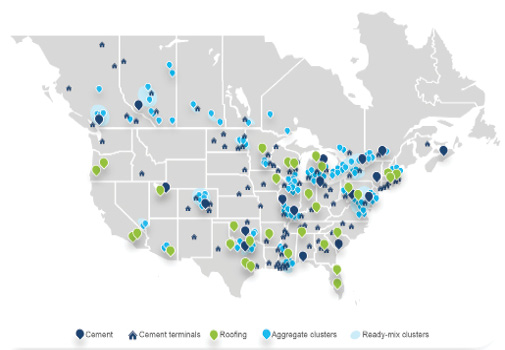

With an eye to unlocking North American asset value, Holcim Ltd. plans a 2025 spin off of its namesake US and Building Envelope plus Lafarge Canada Inc. operations, the new entity likely listed on the New York Stock Exchange. Across 850-plus sites and a payroll north of 16,000, the three businesses hold top five U.S. and Canadian market positions in cement, aggregates and ready mixed concrete, along with key stakes in commercial and residential roofing. A full capital market separation from sister units in Latin America, Europe and other overseas markets, Holcim Ltd. notes, will yield a listed company committed to driving long-term growth in rapidly expanding North America, well positioned to fully capitalize on the region’s infrastructure and construction boom.

“Holcim has reached a new level of financial performance and a superior earnings profile with industry-leading margins and a strong balance sheet,” says Chairman Jan Jenisch. “The success of our North American business makes it the leading pure-play building solutions company in the region. With a U.S. listing, we will unleash its full potential to be the partner of choice for our customers in one of the world’s most attractive construction markets.”

“This business has a proven track record of outstanding profitable growth with an average annual growth rate of over 20 percent and an over-proportional growth in EBIT of more than 26 percent, on average, over the past four years,” he adds. “It will execute an accelerated growth strategy to achieve more than $20 billion in net sales and more than $5 billion in EBIT with industry-leading margins by 2030.”

INVESTOR PIQUES

The Holcim US, Lafarge Canada and Holcim Building Envelope spin off plan coincides with investor interest in construction materials production assets at its highest level in generations. A business encompassing Holcim North America holdings is poised to emerge on the heels of record or near-record valuations for New York Stock Exchange-traded peers with major or sizable stakes in U.S. and Canadian cement, aggregates and concrete markets: Arcosa Inc., CRH Plc, Eagle Materials, Knife River Corp., Martin Marietta Materials, Summit Materials and Vulcan Materials.

Arcosa and Knife River are the products of 2018 and 2023 spin offs from Trinity Industries and MDU Resources Group. Over a five-year window, Arcosa shares climbed from $31 to a $78-$82 range in late-2023 and early-2024 trading. Knife River shares have gained from a June premier of $36 to a $63-$67 range since late 2023. In mid-January, Summit Materials completed a merger with Argos North America, significantly raising its stakes in U.S. cement and ready mixed concrete production. Its stock has remained near record territory in the company’s 13-year history of NYSE listing, even with the issuance of 31 million new shares to Cementos Argos S.A. as part of the merger agreement.

In their February 2023 announcement of a proposed primary listing move from the London Stock Exchange to the New York Stock Exchange, CRH officials cited the prospects for increased commercial, operational and acquisition opportunities and “delivering even higher levels of profitability, returns and cash for shareholders.” CRH shares have gained about 20 percent since their September 2023 NYSE debut.

The most compelling case for a separately listed entity of Holcim operations in the U.S. and Canada can be made with investor sentiments surrounding Eagle Materials, Martin Marietta Materials and Vulcan Materials, whose cement and aggregate production portfolios have exhibited higher earnings one quarter after another. While all three producers comfortably weathered 2020-21 pandemic disruptions, their appeal to investors is especially indicated in valuations maintained or extended since the Infrastructure Investment and Jobs Act was signed in November 2021. Over the past 26 months, each has close