The sticker shock Americans are exhibiting in supermarkets, gas stations, and retail establishments is resounding throughout our economy, at a pace faster than I would have expected. The rampant inflation caused by the global supply/demand imbalance and related supply chain issues has ignited inflation from near zero to levels not seen since the 1980s. So with few options, the Fed has initiated a bare-knuckled, fisticuffs battle with inflation—putting that fight first, at the cost of higher interest rates and a slowing economy.

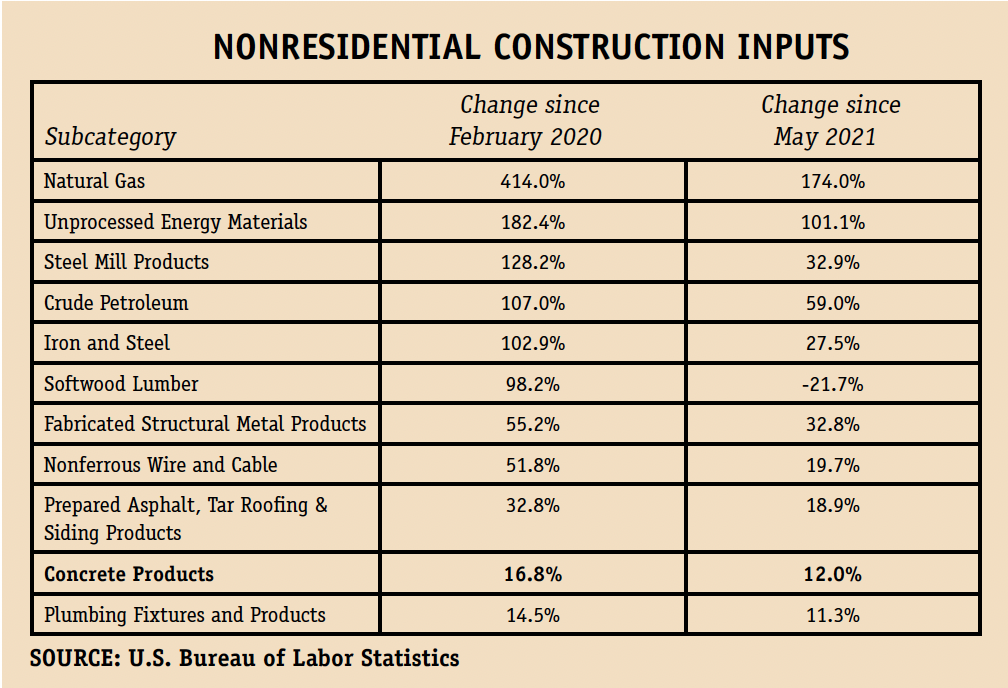

This reality is witnessed throughout all the goods and services we consume, including the majority of construction products across the board. Now, a new U.S. Bureau of Labor Statistics Producer Price Index report confirms rampant inflation levels of greater than 50 percent among eight of 11 nonresidential construction input subcategories. An Associated Builders & Contractors analysis finds segment prices up 21.9 percent year-over-year through May, and 44.4 percent since February 2020. Plumbing Fixtures and Concrete Products prices have exhibited the most stability, respectively rising 11.3 percent and 12 percent and 14.5 percent and 16.8 percent over the 12- and 26-month periods.

While concrete products may be a poster child for tame inflation, producers should work hard to be sure their input costs, i.e., sand, stone, cement, and admixtures, get passed along to their customers, which is easier said than done. Many producers are now negotiating escalator clauses into their bids to protect from material price increases.

ABC Chief Economist Anirban Basu’s outlook confirms what we all know. He says “inflationary pressures show no signs of abating. For months, economists and others have been expecting inflation to peak and then subside. Instead, the Russia-Ukraine war has disturbed markets, driving energy prices higher. Those prices are now circulating across the economy, affecting manufacturing and distribution, and there is little prospect for inflation to meaningfully subside during the weeks ahead.”

He goes on to says that policymakers will continue to aggressively combat inflationary pressures. But what the Federal Reserve most directly affects is demand for goods and services, not supply. By tightening monetary policy and raising interest rates, it will suppress demand over the rest of the year. Eventually, suppliers will respond to diminished demand. The fear is their bare-knuckled inflation battle could drive the economy into recession in the months ahead.

Basu goes on to report that “based on the historical lag between the performance of the economy and nonresidential construction spending, more difficult times could be ahead for contractors in 2024 or 2025. Looking at the most recent reading of ABC’s Construction Confidence Index, contractors are already seeing momentum slow. The likely exception is public contractors, who will continue to benefit from stepped-up infrastructure spending.”

This outlook simply confirms the already-shaken confidence of consumers, which has suddenly plunged to historic lows in recent weeks. As I have stated so many times in the past, consumers represent 70 percent of gross domestic product, and their sentiment reaches into every corner of our economy. For our industry, the challenge remains to balance input costs with selling prices to assure we are maintaining our margins.

Pierre G. Villere serves as president and senior managing partner of Allen-Villere Partners, an investment banking firm with a national practice in the construction materials industry that specializes in mergers & acquisitions. He has a career spanning almost five decades, and volunteers his time to educating the industry as a regular columnist in publications and through presentations at numerous industry events. Contact Pierre via email at [email protected]. Follow him on Twitter – @allenvillere.