From the Associated Builders & Contractors, Washington, D.C. … The U.S. Department of Labor’s Office of Inspector General (OIG) cites outdated wage schedules and union-favoring tendencies in an audit report on prevailing wage rates the David-Bacon Act (DBA) mandates on federal or federally assisted construction projects. As of September 2018, the OIG and report authors found:

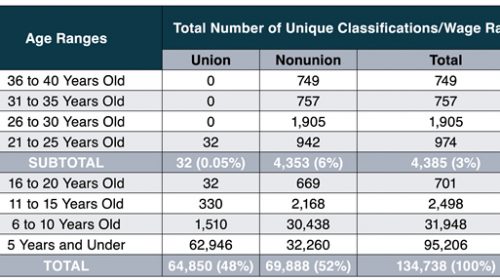

- Of the DOL Wage and Hour Division’s 134,738 unique published labor rates, 3 percent, or roughly 4,400, had not been updated in 21 to 40 years;

- Of 124 wage rates in seven sampled surveys, 48 percent were not determined from data about a single construction worker within the 31 counties that the published rates represented;

- Union wages prevailed for 48 percent of the wage determinations, despite the fact that just 12.8 percent of the U.S. private construction workforce is unionized;

- Less than .01 percent of 64,850 union wage rates were more than 10 years old, while 10 percent of the 69,888 nonunion wage rates were more than 10 years old; and,

- Union rates are typically updated when locals renegotiate collective bargaining agreements, while WHD must conduct new wage surveys to update nonunion rates.

| WAGE RATE DATA: AGING GRACELESSLY |

|

|

| In their report for the Wage and Hour Division, Department of Labor Office of Inspector General auditors chart the dated nature of nonunion worker wage data in the WHD Wage Determinations Generation System. Union rates are typically adjusted upon collective bargaining agreement renewals, while updated nonunion work rate data collection hinges on new WHD surveys—participation in which lags. System classifications reflect local market conditions across the country for the spectrum of trades embodied in building, heavy, highway and residential project categories to which Davis-Bacon Act terms apply. |

Passed in 1931, DBA requires contractors to pay no less than the local prevailing wage to on-site workers on federally funded construction projects exceeding $2,000. To update existing wage determinations, WHD conducts surveys to collect and compile data about hourly rates and fringe benefits paid to workers on four types of projects: building, heavy, highway, and residential. The DBA requires contracting officers to include the appropriate wage determination in bid solicitations and awards for covered work, including projects financed in part with federal funds. During FYs 2014–2017, more than 70 federal agencies spent upward of $170 billion on DBA-bound construction.

For more than 20 years, OIG, along with the White House Office of Management and Budget, Government Accountability Office, U.S. Congress and other stakeholders, have raised concerns about the timeliness and accuracy of prevailing wage rates, especially given the potential bias produced by surveys’ voluntary nature.

As part of its April 2019 report, OIG lists eight recommendations to improve the overall quality and accuracy of DBA prevailing wage rate records. They include developing and implementing a risk-based strategy to manage rates more than 10 years old and consulting with the U.S. Bureau of Labor Statistics (BLS) to evaluate alternative methods to update wage rates, such as the Consumer Price Index and Occupational Employment Survey data. Report authors also note contractors’ lack of participation in filling out wage surveys and OIG’s continuing efforts to identify new strategies to increase response rates and obtain more relevant wage data.

In addition to advocating for DBA repeal, Associated Builders & Contractors has made numerous recommendations over the years that could have mitigated some of the law’s damage to the economy, including the use of BLS data for wage determinations. Beyond federal contracts, research confirms that state prevailing wage requirements increase the cost of construction. A 2017 Empire Center for Public Policy report found that such requirements inflated the cost of publicly funded construction projects in New York by 13 to 25 percent. The State of Ohio saved almost $500 million following repeal of prevailing wage rules on school construction, according to an Ohio Legislative Service Commission study.

Because of their anti-competitive and inflationary impact, ABC notes, 24 states have no prevailing wage laws; eight have repealed or significantly reformed such laws since 2015. The Congressional Budget Office estimates the federal government would spend less on construction, saving $12 billion in discretionary outlays from 2019 through 2028, if DBA were repealed. Industry stakeholders believe the overall total would be much greater when accounting for savings tied state and local government-procured projects freed of DBA constraints.

The Beacon Hill Institute at Suffolk University in Boston found that wages on federally funded construction projects under the DBA are grossly inflated. Its 2008 study compared the methods used by the BLS and DOL Employment Standards Administration’s Wage and Hour Division to determine the prevailing wage for workers employed on federally funded construction projects. The Beacon Hill study determined that the WHD’s inaccurate measurement of wages has several principal consequences for construction wages and costs. Division methods, for example, inflate wages by an average of 22 percent and construction costs on projects subject to the DBA by 9.91 percent.