Higher volumes of vehicles on the road over the next 25 years stand to spur a 5 percent gain in cement shipments for bridges above present consumption levels. A new Portland Cement Association Market Intelligence report estimates the U.S. will need as many as 140,000 new or substantially reconfigured bridges by 2040, nearly 60 percent or 81,200 of which will be concrete.

“With more people on the roads, existing bridges will increasingly become chokepoints. As a result, more cement will be needed either to build new bridges or add lanes to existing ones,” says PCA Chief Economist and Senior Vice President Ed Sullivan, author of “Bridge Market Assessment.” The overwhelming percentage of bridge cement consumption today is attributed to expansion (81 percent) versus replacement (14 percent) or rehabilitation (5 percent) work, he adds.

Through 2040, “Bridge Market” finds: Expansion projects reaching 92 percent of bridge cement consumption; baseline U.S. population growing by 59 million, a 17.4 percent increase from 2016; licensed-driver ranks growing by nearly 40 million; the number of vehicles on the road rising by nearly 53 million; total annual vehicle miles travelled on U.S. roads and highways increasing 600 billion miles; and, projected number of annual bridge crossings climbing from 733 billion in 2015 to nearly 867 billion. To meet traffic capacity demands, PCA expects annual bridge sector cement consumption averaging 6.2 million metric tons during the 2017-2040 window—against a 5.9 million metric ton annual average since 2010.

|

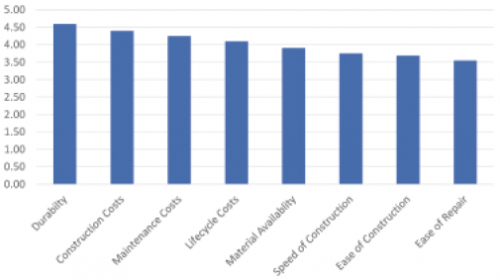

SELECTION FACTORS DETERMINING BRIDGE MATERIAL 5.0 = Extremely Important |

|

|

The PCA Market Intelligence report also underscores the significance bridge projects have gained this century: In 2000, bridge cement consumption accounted for 3.6 million tons or 3.7 percent of powder shipments. At 6.7 million tons, bridge market consumption represented 7.5 percent of 2015 cement shipments.

“As population and the number of drivers on the road increases, so will total vehicle miles travelled and bridge crossings. The combination of increased crossings and rising vehicle weights suggest an acceleration in bridge stress during the years ahead,” the report notes. “This, coupled with the fact that older bridges had fewer crossings and lighter vehicle weights during the course of their lives, suggests more bridges will reach structurally deficient status earlier in their lives under similar bridge rehabilitation spending as in the past.”

“Bridge Market” is derived from a comprehensive research project to spotlight long-term opportunities for cement and concrete in building and non-building applications. Researchers targeted data to support estimates of construction activity based on economic, demographic and structural issues, plus material market share trends in key segments.