Portland Cement Association’s European counterpart adds valuable perspective to a cement production and climate change dialog, responding to critics of member companies’ European Union Emissions Trading Scheme (EU ETS) participation.

“Cement is at the start of a supply chain that provides a durable, energy-efficient and low carbon product that is essential for building the houses, schools, hospitals and infrastructure of tomorrow,” observes Cembureau. In formulating cementitious materials for concrete, it adds, “The industry has an established track record in reducing clinker content, whereby it seeks to balance environmental benefits with care for technical and durability performance requirements.”

Cembureau is answering a challenge to the free allowances producers enjoy under the EU ETS, which prices CO2 emissions by the metric ton, and will ultimately add to the cost of cement. For now, industry sectors realize allowances based on historical production levels and, where applicable, the prospect of imports from sources not abiding EU greenhouse gas emissions reduction strategies. The group underscores the market realities of a dynamic, global business like cement, plus producers’ strides in lowering CO2 emissions while delivering a vital construction product synonymous with long life cycle.

|

|

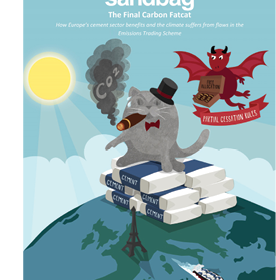

| No denying climate watchdog’s sense of humor. |

Sandbag, a United Kingdom think tank, questions allowance levels for multinational producers behind the bulk of EU powder milling: Buzzi Unicem, Cemex, CRH, HeidelbergCement, Italcementi and LafargeHolcim. Under the EU ETS, the group contends, the companies banked 2008–2014 allowances valued at more than 1 billion euro ($1.14 billion). In its March 2016 report, “The Final Carbon Fatcat — How Europe’s cement sector benefits and the climate suffers from flaws in the Emissions Trading Scheme,” Sandbag argues that “Firms have been able to retain maximum free allocation, corresponding to peak production, by keeping a range of their facilities operating at just above 50 percent of historic levels … This loophole has resulted in windfall profits and a de facto production subsidy for highly carbon-intensive clinker.”

Windfall profits? Buzzi, CRH, Cemex, Heidelberg, Italcementi and LafargeHolcim management and investors might beg to differ, having seen their EU plants weather seven years of demand at 40 percent or lower than pre-2008 levels. “The cement industry in Europe has been one of the hardest hit by the economic crisis,” affirms Cembureau, its “returns below the cost of capital.”

In wider “decarbonization” policy terms, Sandbag offers a suggestion to which many in the performance versus prescriptive specification camp can relate: Spurring demand for non-portland cements, where governments showcase alternative binders through demonstration projects and procurement programs. Among carbon-negative varieties of cement, it notes North American material and process specialists Solidia Technologies, which has developed an integrated binder and CO2-based curing system, listing LafargeHolcim and Federal Highway Administration among its partners and collaborators; and, CarbonCure Technologies, whose CO2 injection methods are established in U.S. and Canadian concrete masonry production and emerging in ready mixed—as demonstrated this month (page 66) at Atlanta’s Thomas Concrete.

If they take the time to look beyond ETS allowance balances of an industry climbing out of an especially deep trough, Sandbag accountants will see how cement producers and their customers are capably advancing a decarbonization agenda on market terms.