by Pierre G. Villere Those of us who are older and have had multi-decade careers have seen this play out before in Washington, D.C.: The opposing party wins the White House, and a majority in both houses of Congress. While the 50-50 split in the Senate is not technically a majority, the vice president holds the power to break a…

Read MoreTag: tax reform

Tax reform a principal catalyst behind $100M precast plant venture

Fortified Precast Technologies, LLC has outlined an ambitious Florida residential real estate development plan, leveraging a partnership with German precast concrete production specialist Vollert Group and Opportunity Zone provisions in the Tax Cuts & Jobs Act of 2017 (TCJA). The company’s Fortified Precast Opportunity Fund is authorized to raise $100 million in $20 million increments to build five plants incorporating Vollert mix delivery, form pallet and companion robotics or casting components. At 32,720 sq. ft. of daily wall panel output, each operation would be capable of supplying more than 4,200 home projects annually. The capacity would be initially targeted to the Sunshine State market, which has seen residential building permits climb from 116,200 in 2016, to 122,700 in 2017 and 142,300 last year.

Read MoreTax reform codifies fairness model for resilient-building advocates

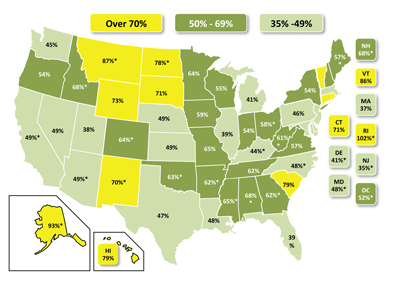

California and New York officials groused at the state and local tax (SALT) deductibility cap in the Tax Cuts and Jobs Act. Proponents of the new law rightly noted how the rest of the country had subsidized those and a few other states whose residents could lower their federal income tax liabilities by itemizing state and/or local income and property tax payments.

Read MoreHeidelbergCement: U.S. tax reform a plus after $240M charge for 2017

Sources: HeidelbergCement AG, Germany; CP staff

Lehigh Hanson parent company HeidelbergCement estimates a €200 million ($240 million) charge against net 2017 profit due to accounting measures stemming from the Tax Cuts and Jobs Act —the sweeping tax reform President Donald Trump signed into law late last year. The law reduces the federal corporate tax rate from 35 percent to 21 percent, but requires companies like HeidelbergCement to recalculate loss carried-forwards and deferred tax assets on losses in their consolidated 2017 financial statements. The one-time action will not impact earnings before tax or cash flow in 2017, HeidelbergCement notes, adding that the new U.S. tax rate will positively affect group net profit and cash flow beginning in 2019.

Read MoreLead economist projects 3 percent growth in 2018 construction activity

Sources: Dodge Data & Analytics, New York; CP staff

Total U.S. construction starts for 2018 will reach $765 billion, a 3 percent gain from this year’s projected level of $745 billion, according to Dodge Data & Analytics Chief Economist Robert Murray, who cites several positive factors suggesting the construction expansion that began in 2012 “has further room to proceed.”

Read MorePCA factors weather, agency budgets in minor 2017-18 forecast revisions

Sources: Portland Cement Association, Skokie, Ill.; CP staff

The latest PCA forecast of U.S. cement consumption sees year-over-year gains of 2.6 percent and 2.8 percent in 2017 and 2018 versus uniform 3 percent levels projected earlier this year. Bad weather, especially in the high volume concrete markets of Florida and Texas, coupled with lower anticipated public construction sector budgets are behind the more modest growth outlook.

Read MoreROAD BUILDERS CONCUR WITH WHITE HOUSE ON TRANSPORTATION FUNDING REAUTHORIZATION

The American Road and Transportation Builders Association reacted favorably to the Obama administration’s FY 2015 budget, released early last month, which recommends investing $90.9 billion in transportation improvements, a proposed $18.6 billion over the FY 2014 amount, or a 25.7 percent increase. In a follow up to the president’s late-February outline MAP-21 reauthorization priorities, the administration again called for a four-year, $302 billion surface transportation program from FY 2015 through FY 2018.

Read More