Federal policy is vital to accelerate deployment of technologies that can curtail industrial sector carbon dioxide emissions, Portland Cement Association asserts in response to the U.S. Department of Energy Advanced Manufacturing Office’s (AMO) “Request for Information on Industrial Decarbonization Priorities.”

Absent strong support from Washington, D.C., an AMO timeline to reach carbon neutrality across industry is unrealistic due to technical, legal and economic challenges attending carbon capture utilization and storage (CCUS); hydrogen fuel adoption; or, specific to cement production, kiln electrification. “Federal policy must accelerate the significant technology, funding, and market innovation needed for rapid decarbonization while preserving economic growth and international competitiveness,” says PCA Senior Vice President of Government Affairs Sean O’Neill. “The adoption of CCUS is key to achieving deep decarbonization.”

He and PCA colleagues also note in AMO RFI comments: CCUS methods deployed in limestone to clinker conversion phases would address 60 percent of cement sector CO2 emissions; with the right federal and state policies, those methods could become scalable over the next 10 years, yet permitting, infrastructure and funding challenges remain; tax incentive reforms and Energy Department loan programs would accelerate early CCUS investment and adoption in cement production; and, while hydrogen fuel usage and kiln electrification present potentially transformative emissions reduction strategies, neither will be viable for at least 15-20 years. Beyond CCUS and kiln power observations, they cite cement and concrete stakeholders’ Roadmap to Carbon Neutrality, an October 2021 proclamation of carbon dioxide emissions reduction measures over the next 30 years.

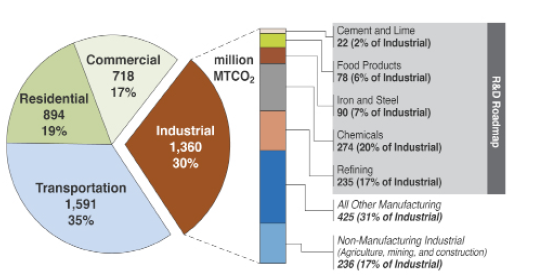

SECTOR INVENTORIES

ECONOMIST MEASURES UKRAINE IMPACT ON U.S. CONSTRUCTION

Portland Cement Association Chief Economist Ed Sullivan cites the potential for a dip in cement consumption and concrete output attributable to the Russia-Ukraine conflict. At a joint luncheon in San Antonio during the co-located PCA Spring Meeting and National Ready Mixed Concrete Association 2022 Convention, he offered three scenarios:

- War. Conflict expands beyond Ukraine borders; against 2021 cement consumption levels (up 4.1 percent from prior year), shipments decline 0.8 percent and 5.8 percent in 2022-2023, but rebound with a 2.3 percent gain in 2024.

- Baseline. Conflict is confined to Ukraine borders; cement demand holds for 1.2 percent increase in 2022, drops 0.8 percent next year, and rebounds a 2.0 percent in 2024.

- Everything Works. Diplomatic solution to conflict; 2022-2024 cement shipments climb 3.0 percent, 2.8 percent and 3.3 percent, respectively.

The scenarios would equate to U.S. powder consumption ranging from about 108 million metric tons to just over 120 million metric tons annually over the three-year window. Beyond the Ukraine factor, Sullivan underscored other developments shaping near-term cement demand: Continued decline of Covid-19 infection and death rates; residential market softening, with 2022 growth projected at 8 percent, half that of 2021, and subsiding the next two years; gradual escalation of Infrastructure Investment and Jobs Act transportation funding, especially for 2023-2024; and, continued caution surrounding nonresidential building, especially retail properties.