A White House 2021 regulatory update, coupled with a U.S. Senate vote on a Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act amendment, illustrate administrative and legislative branch underpinnings for one of the most contentious statutes affecting construction: the Davis-Bacon and Related Acts (Davis-Bacon or DBRA).

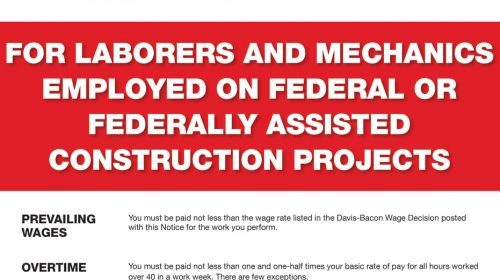

Among U.S. Department of Labor responses to a White House executive order is a Wage and Hour Division proposal “to modernize the regulations implementing the DBRA to ensure workers are truly paid prevailing wages on federal construction contracts.” The proposal would appear to alter long established survey methods with which Division staff set compensation levels on federally funded building and nonbuilding contracts valued at $2,000 and up.

Separately, support for or concurrence with construction worker wage supports was indicated in a June vote where 58 Senators rejected an amendment stripping Davis-Bacon standards from the CHIPS Act. The International Association of Bridge, Structural, Ornamental and Reinforcing Iron Workers (Ironworkers) called it the Senate’s first major floor vote on Davis-Bacon provisions in more than a decade and “a resounding victory for American workers.”

Joining the 50-member Democratic Caucus voting nay were Republican Senators Roy Blunt (MO), Steve Daines (MT), John Kennedy (LA), Shelly Moore Capito (WV), Lisa Murkowski and Dan Sullivan (both AK), Rob Portman (OH) and Marco Rubio (FL). “This expanded list of Republican Davis-Bacon supporters proves that bipartisan agreement is still possible on commonsense issues such as the quality jobs supported by prevailing wage,” the Ironworkers contend.

Concurrent with the Davis-Bacon modernizing, the Wage and Hour Division plans to draw regulations that will increase the hourly minimum wage rate paid by parties that contract with the federal government to $15 for those employees working on or in connection with a covered federal government contract.

LEHIGH EXITS KEYSTONE DEAL TO FTC DELIGHT

HeidelbergCement AG of Germany and Elementia S.A.B. de C.V. of Mexico, along with their North American subsidiaries—Lehigh Hanson Inc., Lehigh Cement Co. LLC and Giant Cement Holding, Keystone Cement Co., respectively—have terminated an agreement regarding the sale of Keystone’s Bath, Pa. plant to Lehigh Cement. The move responds to a U.S. Federal Trade Commission contention that the $151 million transaction would decrease from four to three the number of significant gray portland cement suppliers serving 36 eastern Pennsylvania and 12 western New Jersey counties.

After a lengthy review of the proposed deal, which HeidelbergCement and Elementia announced in September 2019, the agency had set a November 2021 administrative trial date to prove its allegations of Federal Trade Commission Act and Clayton Act violations. Staff cited the suitor’s ownership of two Lehigh Valley area plants—Evansville and Nazareth, with combined annual production capacity north of 3 million tons—within 40 miles of Keystone’s 1.2 million ton/year operation in Bath. FTC officials saw that plant positioning Lehigh Cement with more than 50 percent of gray powder shipments in the eastern Pennsylvania and western New Jersey counties. According to a May 2021 agency complaint, Lehigh and Keystone are close competitors for many cement customers, and the latter’s aggressive pricing has caused the former to lower its prices and compete more vigorously in the relevant market.

“Neither new entry nor expansion by other market participants is likely to prevent the acquisition’s anticompetitive effects. No new plants or terminals have been constructed in eastern Pennsylvania or western New Jersey in over 30 years,” FTC noted in its administrative action announcement. “There are also significant barriers that would make new entry slow and difficult, such as substantial sunk costs, environmental and regulatory requirements, economies of scale, and industry expertise.”