Last year saw ready mixed concrete producers adopt paperless documentation for common procedures in a big way. Many such measures were focused on customer service activities and quality control, yet officials from Florida-based Link2Pump suggest it might be time to extend paperless documentation to a fleet fueling system.

Paperless fuel tracking offers producers great efficiencies, they contend: Moving off of a clipboard and into the cloud positions fleet owners to decrease system or vehicle misuse or outright thievery; reduce recording errors; and, focus post-trip inspection reports on maintenance and repair concerns. Link2Pump Vice President of Sales Todd Hawkins reminds producers that there is likewise a greater financial benefit to paperless fuel tracking as systems can be incorporated into the firm’s software to accurately measure how each gallon is used. Armed with such important data, managers can reconcile all the information needed for filing for fuel tax refunds.

THE POWER OF A REFUND

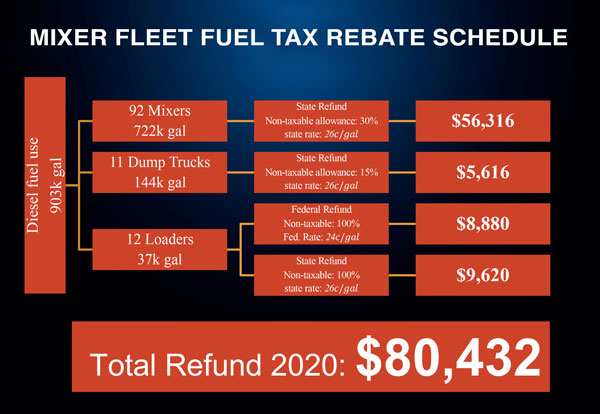

According to Hawkins, excise taxes on diesel and gasoline often can be between $.50 to $.1.25 per gallon depending on the state. Fuel used to power off-road equipment is exempt from such taxes. Even more important for producers, many states also exempt fuel consumed in power-take-off functions driving mixers, dumps and bulk cement tankers. In many jurisdictions, ready mixed producers can claim up to 35 percent of the total fuel purchased for mixer operation. Since fuel expenses are often one of the top three budget line items, accurate monitoring of diesel consumption and timely tax rebate filing can potentially save tens of thousands of dollars.

Hawkins cites new L2P software as providing a complete high-tech solution to control fleet fueling. The system allows producers to collect data from both a plant fuel tank or a mobile fuel truck. Devices capture data and instantly post it in a secure online account. Approved managers can access figures in real time from their devices or desktop computers. Fuel data can be organized by vehicle and application to monitor potential excise tax rebates.

“Many producers track their fleets manually, but after automating the data collection process, they discover significant increase in verified non-road fuel usage,” observes Hawkins. “When you add up all the potential operations that can be applied for rebates, the savings add up with a very fast return on investment of the system. Our largest client has seven batch plants and about 90 mixers. Their 2020 rebate is over $100,000.”

A ROBUST SYSTEM

L2P software and companion fuel station hardware are widely used throughout the Americas, with thousands of field installations. To activate a fuel pump in the plant or yard, the driver is assigned a unique passcode that tracks driver, vehicle, and mileage or hours. When the system activates the pump, the operator fills up the tank and the L2P software records gallons pumped.

When fueling is completed, the program immediately uploads all data to the producer’s secure account. Since data is available in real-time, fleet managers can review and manage it from any device. It’s a simple way to be sure that a mixer truck, for example, is fueled between shifts on continuous pour nights and gain an additional level of security when dispensing a valuable commodity, regardless of vehicle. — Link2Pump, Boca Raton, Fla., 804/212-2290; www.link2pump.com