Producers anticipate industry trends by studying today’s performance data

By: Craig Yeack

Ready mix is a real-time business. It’s now or never. Get it shipped or lose the volume, forever. And right now, it’s more real-time than ever.

Driving any business requires looking out the windshield, as well as checking the rearview mirror. Our industry follows a much more winding road than most others, dominated by intense market segment and regional variations. So how do we use the information to look forward and navigate the road ahead?

One of the industry’s most widely referenced resources is the National Ready Mixed Concrete Association’s (NRMCA’s) annual “Performance Benchmarking Survey.” Credit must be given to the group that established this report and continue to compile and share it with producers each year. The NRMCA identified the need for benchmarking and crafted the best possible solution for its membership: Voluntarily reported information for the prior year, complied and released during the midpoint of the following year. For a high-level understanding of our industry’s performance year over year, the survey is top shelf.

The importance of the collective Performance Benchmarking Survey for our industry cannot be overstated. However, the value of reported information to navigate the immediate future begins to diminish with age. Many producers are looking to new tools to help navigate tomorrow, next week and next month especially during these challenging times.

STRENGTH IN NUMBERS

The traditional networking and benchmarking within our industry is growing stronger along with shared technology resources. For example, concrete producers across the country are pooling time and treasure in the Bulk Construction Materials Initiative (BCMI). The group is developing a platform of cloud-based, modern tools for analytics and quote-to-cash transactions.

By tapping into real-time operational data, first for ready-mix and now aggregates, cement and asphalt, there is an abundance of real-time information. Supporters can instantly see the status of their operations and identify trends. They can also opt in to receive real-time reporting of actual, anonymized data to compare their performance against industry peers.

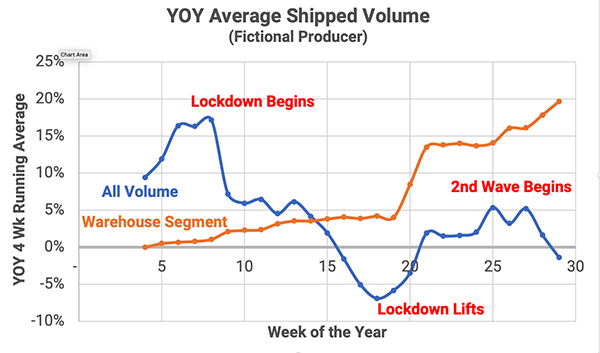

Consider basic shipped volume. Producers using the BCMI platform have access to real-time information graphs showing their overall company or regional volume for any desired timeframe. They also have the option to see how this volume compares with other producers’ activity across the U.S. (See graph, ‘YOY Average Shipped Volume’)

While lockdowns are an obvious concern right now, perhaps more important is business segmentation. None of us has forgotten the attraction to supplying homebuilders in the run up to the Great Recession and the subsequent agony of overexposure to a single segment. Now anything to do with warehousing is booming: Amazon is even building its own airport in the Cincinnati area. To steal a line from Robert Palmer, ‘It’s simply irresistible.’ Now more than ever we need to monitor the real-time impact by region and segment to exploit hot markets and transition to others when they start to wane. (Beware, tracking such trends requires accurate and consistent data entry such as standard work types on orders—a practice that often proves challenging for producers.)

A key premise is that our “market” never really was monolithic, just our ability to get the information. We need to see trends sliced in ways appropriate to our business; for example, warehouse construction volume by urban/suburban/rural market, by county/zip, and in the states where we have operations. Then we need to do the same across the nation to spot trends before they roll into our area.

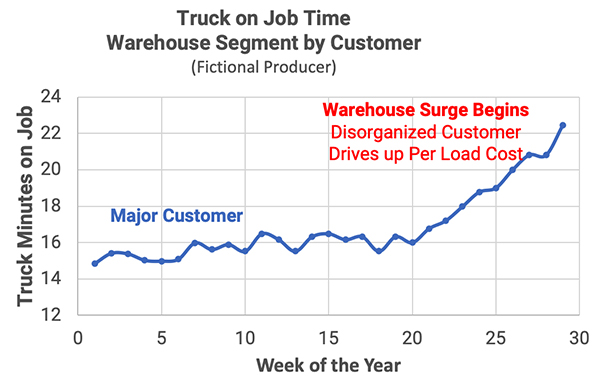

Extend the thought further to core operating principles like margin over material and building better customers through more efficient truck utilization. Real-time benchmarking and continuous improvement of these fundamental profit influencers are critical when a producer’s road takes a sharp dip.

In the warehouse boom scenario, the average selling price is high enough to allow slips in operational efficiency to be overlooked. For instance, many producers report reduced efficiencies for profit driving metrics such as Truck on Job. Customers, albeit willing to pay handsomely, are rushed and less attentive the use of producers’ resources. (See graph, ‘Truck on Job Time, Warehouse Segment by Customer’) For the short term this can be tolerated, but for the longer term, producers need to keep working with customers to plug the profit holes that ultimately affect everyone involved.

The cyclical nature of the business means we have to grab profit when it’s here, while also preparing for the lean times by plugging profit leaks. Every tool in the box is great for something so let’s acknowledge our strength in numbers and start using the right tools for the future.

Craig Yeack has held leadership positions with both construction materials producers and software providers. He is co-founder of BCMI Corp. (the Bulk Construction Materials Initiative), which is dedicated to reinventing the construction materials business with modern mobile and cloud-based tools. His Tech Talk column—named best column by the Construction Media Alliance in 2018—focuses on concise, actionable ideas to improve financial performance for ready-mix producers. He can be reached at [email protected].

Craig Yeack has held leadership positions with both construction materials producers and software providers. He is co-founder of BCMI Corp. (the Bulk Construction Materials Initiative), which is dedicated to reinventing the construction materials business with modern mobile and cloud-based tools. His Tech Talk column—named best column by the Construction Media Alliance in 2018—focuses on concise, actionable ideas to improve financial performance for ready-mix producers. He can be reached at [email protected].