From the Associated Builders & Contractors, Washington, D.C. … The U.S. House of Representatives has passed the Rehabilitation for Multiemployer Pensions Act (H.R. 397), with 29 Republicans joining the majority in a 264-169 vote. Advocates argue the measure is needed to protect the pensions of 1.3 million workers in certain multiemployer pension plans (MEPP)—up to half of which cover construction trades participants—and prevent a Pension Benefit Guaranty Corporation (PBGC) collapse.

Critics maintain the legislation is a taxpayer-funded bailout of MEPP and does little to address their fundamental structural flaws. “[It] fails to include any reforms that would ensure responsible funding of future benefit promises or prevent a similar situation from recurring,” said Rep Virginia Foxx (R-N.C.) during H.R. 397 debate. “The bill also fails to address the chronic underfunding that plagues the entire union multiemployer system and passively accepts that plan trustees and actuaries may continue to underestimate pension promises—to the detriment of workers and retirees.”

Also known as the Butch Lewis Act, H.R. 397 was introduced by Rep. Richard Neal (D-Mass.); Senator Sherrod Brown (D-Ohio) introduced the companion in the upper chamber. Unionized construction trade contractors generally participate in a defined benefit MEPP, notes the Associated Builders & Contractors, while nonunion contractors typically provide defined contribution plans such as portable 401(k) retirement accounts.

Lawmakers have pushed construction industry contractors and workers into MEPP via so-called responsible contractor laws and government-mandated project labor agreements (PLA) on taxpayer-funded construction projects, ABC observes. Nonunion contractors, on the other hand, are typically wary of competing for contracts subject to such terms because MEPP can expose them to potentially catastrophic liability and harm retirement prospects for their workforce if plans fail.

If MEPP become insolvent, they are taken over by the PBGC, an independent agency of the federal government that a) monitors and privately insures pension benefits in private sector defined-benefit plans; and, b) provides qualified individual beneficiaries up to $12,870 per year in defined benefits in certain circumstances. The agency is projected to become insolvent around 2025-26, partly due to exposure to struggling MEPP. An ABC analysis of PBGC data indicates the construction industry is responsible for almost half of the current PBGC-backed MEPP underfunding and is a primary contributor to projected future PBGC MEPP insurance program funding shortfalls.

Senate Majority Leader Mitch McConnell (R-Ky.) has not indicated whether the full Senate would take up the H.R. 397 companion. ABC has not taken a position on the bill but will continue to monitor all legislative proposals concerning the PBGC and MEPP, and oppose government-mandated PLA and other laws mandating contractor and employee participation in MEPP.

PBGC ALARM BELL

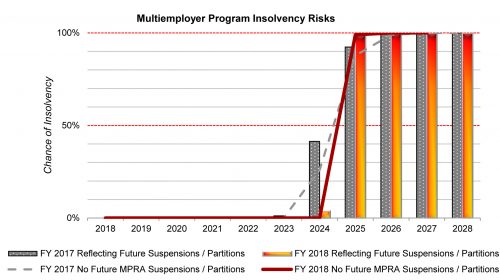

Within two weeks of the H.R. 397 passage, the PBGC issued its FY 2018 Projections Report, confirming how the Multiemployer Insurance Program, covering 10 million-plus pensioners, remains on a path to run out of money by the middle of the next decade. The Single-Employer Insurance Program, which covers about 26 million participants, continues to improve and last year emerged from a negative net position or “deficit” for the first time since 2001. Continued future improvement is expected but not assured, and the program remains vulnerable to an unexpected downturn in the economy.

As required by the Employee Retirement Income Security Act, the projections report is PBGC’s annual actuarial evaluation of its future operations and financial status. The report provides a range of estimates of the future status of insured pension plans and their effect on PBGC’s financial condition, based on hundreds of different economic scenarios. Authors observe:

Multiemployer Insurance Program. Absent changes in law, this program’s financial condition will continue to worsen over the next 10 years. About 125 multiemployer plans covering 1.4 million people are expected to run out of money over the next 20 years. More and larger claims on the Multiemployer Program over the next few years will deplete program assets and lead to insolvency by the end of FY 2025.

Projections for FY 2028 show a wide range of potential outcomes, with an average projected negative net position of about $90 billion in future dollars ($66 billion in today’s dollars). If the Multiemployer Program were to run out of money, current law would require PBGC to decrease guarantees to the amount that can be paid from Multiemployer Program premium income. This would result in reducing guarantees to a fraction of current values. PBGC’s guarantee is the amount of retirement benefits the agency insures for each participant, which is capped by law.

President Trump’s FY 2020 Budget contains a proposal to shore up PBGC’s Multiemployer Program by creating variable rate and exit premiums. They would raise an additional $18 billion in premium revenue over the 10-year budget window. The proposal includes a provision allowing for a waiver of the additional premium if needed to avoid increasing the insolvency risk of the most troubled plans.

Single-Employer Program. PBGC’s projection for this program shows that continued improvement is expected but with a wide range of potential outcomes. The Single- Employer Program remains exposed to a considerable amount of underfunding in plans sponsored by financially weak employers. Plans whose sponsors’ credit quality is below investment grade have unfunded liabilities of approximately $175 billion.

The projected 10-year average net position has improved slightly compared to last year’s report but with little change in the variability. PBGC’s future financial condition is sensitive to economic conditions, compelling agency actuaries to run projections using a wide range of economic scenarios. The average projected net position for FY 2028 is a positive $37 billion in future dollars ($27 billion in today’s dollars). Projected improvements in the program’s financial position over the 10-year period are due to a general trend of better funding of pension plans and projected PBGC premiums exceeding projected claims.

|

|

| Actuaries compare the results FY 2017 and FY 2018 insolvency risk projections, absent changes in the law. In every one of their 500 modeled economic scenarios, the Multiemployer Program is projected to be insolvent ahead of FY 2027 (October 2026). SOURCE: PBGC 2018 Projections Report |