In the wake of tightening municipal budgets, environmental violations, and aging infrastructure, private players are poised to capitalize on struggling water and wastewater utilities. A new Bluefield Research report, U.S. Municipal Water & Wastewater: Defining the Addressable Market for Private Investment, estimates the total market value of 78,000-plus community water and wastewater systems across the U.S. to exceed $700 billion.

“We’ve been talking about this trend for several years—municipalities and smaller private system owners’ growing inability to keep up with deteriorating utility infrastructure, so our analysis has been developed as a tool to evaluate the opportunities for investment,” says Bluefield Research President Reese Tisdale. “There seems to be no shortage of interest, and capital for that matter. Rather, the challenge for new market entrants, particularly for those looking to secure a platform from which to grow, is scale. Big deals are difficult to find.”

|

COMPLIANCE COMPELLED Top 15 states for systems with “serious violations” |

|

|

| SOURCE: Bluefield Research |

Approximately 15 percent of community water systems are already owned by private players, including investor-owned utilities; in the first half of 2017, Bluefield tracked more than $224 million of investor-owned utility acquisitions across 53 deals. The most notable proposed transaction by an industry outsider was Eversource’s $1.68 billion takeover of Aquarion. Given the geographic and customer overlap of electricity, gas and water, Eversource anticipates billing, regulatory and branding synergies.

At the extreme end of the spectrum are highly-stressed public water systems—those with a combination of low interest loan forgiveness applications, which signal financial distress, and serious Environmental Protection Agency compliance violations. Bluefield’s analysis estimates these represent almost $2.5 billion of potential deal value. “Herein lies the challenge,” Tisdale observes. “The lion’s share of these systems are smaller and with significant issues, which play into the hands of well-established investor-owned utilities, like American Water and Aqua America, that have more widespread geographic footprints for tuck-in deals.”

Driving private interest in public water systems are number of key market shifts, he adds:

- Public water systems face environmental violations, financial burdens. Approximately 5,300 municipal and private drinking and wastewater systems in the U.S. are listed as significant regulatory violators. “Serious system” is the most significant level of EPA violation designation and indicates an immediate infrastructure investment need.

- Climbing residential water rates are adding pressure to utilities. Adjusting for inflation, the combined water and wastewater bill for a typical U.S. household has increased 18.5 percent since 2012, or 4.4 percent per year on average. This rise is attributed to growing populations, more efficient water usage, and aging systems networks, all of which pressure municipal and utility budgets.

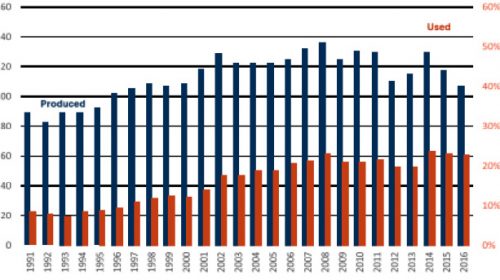

- Federal funding for water infrastructure has decreased. Federal funding for water utilities peaked in 1976 at $16.9 billion and has since fallen to $4.3 billion in 2014, passing the financial burden to states and municipalities. A primary resource continues to be the EPA managed State Revolving Funds, which totaled more than $12.7 billion in 2016-2017 for drinking water and clean water projects across all 50 states.

- States are encouraging private investment in public water systems. Since 2013, Illinois, Indiana, Missouri, New Jersey and Pennsylvania have joined California in facilitating private investment with fair market value legislation. The Mid-Atlantic region hosts the greatest private ownership presence in water systems. Texas and Pennsylvania are hot spots for acquisitions with 90 pending and completed deals in 2017.

Merger & acquisition is not the only approach being considered to resolve America’s water and wastewater infrastructure woes, Bluefield notes. Public private partnerships, including third-party operation and maintenance contracts, plus concessions represent other options. These deals have been slow to gain momentum largely because of local resistance, despite readily available access to capital.

“As water needs grow across the country, we expect the private sector to continue to play a key role, including companies from outside the water industry,” adds Tisdale. “There is no doubt water infrastructure needs serious investment from private or public capital. The status quo is not an option.” — Bluefield Research, Boston, www.bluefieldresearch.com