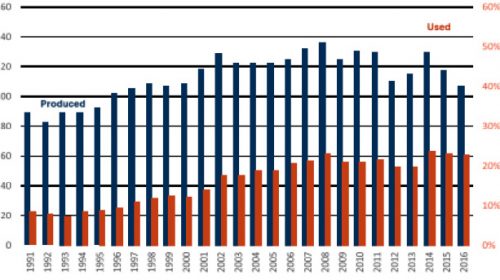

The American Coal Ash Association Production and Use Survey, released late last month, pegs 2016 Class F and Class C fly ash consumption in concrete at 14.4 million tons, down 8 percent from the prior year’s record 15.7 million tons. ACAA attributes the dip to regional supply shortages that resulted from power plant shutdowns and generating stations’ changing fuel profiles. Demand for fly ash remained strong across all concrete markets last year, the group affirms, and utilization likely would have been higher absent logistical disruptions.

Concrete applications represented slightly less than 25 percent of the 60.2 million tons of coal combustion products (CCP) beneficially used last year. That record total represents 56 percent of material generated and made 2016 the second consecutive year in which more than half of coal ash produced in the United States was beneficially used rather than disposed. “The trend continues to be very positive,” says ACAA Executive Director Thomas Adams. “For the third straight year, we have seen significant improvement in the beneficial use rate. We look forward to continuing to grow these practices that conserve natural resources, make products that are more durable, and dramatically reduce the need for landfills.”

The Production and Use Survey finds the 2016 ash utilization rate increasing from 52 percent to 56 percent year over year, although the total volume of material consumed was flat as overall production declined. Last year saw 107.4 million tons of CCP generated, off 7 percent from 2015 levels as coal’s share of the electricity generation mix shrank in response to environmental regulations and competition from other energy sources. Along with concrete market metrics, the survey examines 2016 CCP utilization rates of a) flue gas desulphurization-derived synthetic gypsum, 9.9 million tons in gypsum panel production, down 19 percent year over year due to normal market fluctuations tied to material imports and exports; and, b) boiler slag, 1.3 million tons in blasting grit and roofing granule production.

“As America’s electricity grid changes, the coal ash beneficial use industry is evolving as well,” Adams observes. “As we work diligently to utilize the 44 percent of coal combustion products that are still disposed annually, our industry is also taking significant strides in developing strategies for improving the quality and availability of these materials.”

Increasing CCP beneficial use, he adds, requires ash marketers to ensure that products are consistent and available when customers need them, and weigh large technology and logistics investments. CCP management and marketing stakeholders are likewise harnessing technologies to reclaim previously disposed coal ash stock.

Source: American Coal Ash Association