Portland Cement Association’s new “Survey of Portland Cement Consumption by User Group” underscores mixed year-over-year results among 16 U.S. market or product segments: Nine recorded growth, seven saw reduced volume in 2015 versus the prior year. Those gaining at least 20 percent were, in descending order, waste stabilization & solidification; fiber cement siding; concrete roof tile; soil cement, roller compacted concrete or full-depth reclamation/pavements; precast/prestressed concrete; and, soil cement or roller compacted concrete/water resources structures.

“Survey of Consumption” indicates limited increases or decreases, or flat conditions in 2015 ready mixed concrete, concrete pipe, block & paver, and packaged dry mix volume as measured against 2014 figures. Oil & gas well drilling and street and highway construction segments fared the worst in 2015 compared to prior year activity. Additional information on the survey can be obtained from PCA Senior Analyst Brian Schmidt, [email protected].

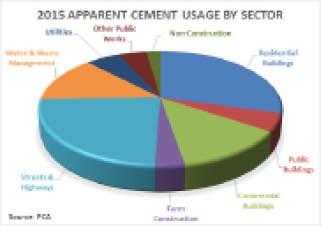

Separately, the latest PCA Market Intelligence Apparent Use series report confirms the role residential and commercial building activity played in last year’s 3.7 percent portland cement shipment gain over 2014, and offsetting volume lost from lower street & highway sector material demand.

Free to members or available for purchase through the PCA Bookstore, www.cement.org, the PCA 2015 Apparent State & Market Report (Spring Preliminary), notes these cement consumption factors by building or construction market: residential rose 11 percent year over year, reaching a level last seen in 2007; commercial sector demand grew for a fifth consecutive year; and, highway project-bound shipments fell about 15 percent after reaching a post-recession high in 2014. The report provides additional 2015 shipment data for other cement end use markets, including water & waste management; public buildings; utilities and other public works; farm construction; and, non-construction.