Industry projections reveal that by 2018, the demand for cement in Texas will exceed the supply for the first time. At about the same time, the Environmental Protection Agency is expected to reduce the ozone standard from 75 ppb to 65 or 70 ppb. As a result, all or portions of Central Texas are expected to be designated as a “non-attainment area” for ozone, making construction of additional capacity significantly more expensive. Here are a few thoughts for cement interests that want to expand their facilities or build new plants in this impending new regulatory environment.

There are three primary factors that will dictate when and how this apocalyptic confluence of events could materialize: demand, production and import capacity; extent of the reduction in the proposed ozone non-attainment standard and whether it withstands legal challenges; and, if it does withstand legal challenge, when the standard becomes effective.

Texas’ population and economic growth is showing no signs of slowing down. By 2020, the population is expected to increase to 30 million, up from 25 million at the 2010 Census. Consequently, demand for roads, buildings, oil rigs/well cement, and other infrastructure is booming, and is predicted to continue. A (Texas Aggregates & Concrete Association) TACA Conveyor cover story recently projected that demand for cement in Texas will exceed its in-state production capacity in 2016, and its combined production and import capacity by 2018.

These projected dates are not “set in concrete,” but are reliable indicators that this will occur soon. Normal market response by the industry would be to expand production. However, adding capacity or building a new cement plant is expensive and time consuming. Moreover, the normal permit process gauntlet can become more demanding depending on several potential regulatory changes, including EPA’s Commercial/Industrial Solid Waste Incinerator (CISWI) rules, Non-Hazardous Secondary Material (NHSM) rules, greenhouse gas regulations, and changes to the National Ambient Air Quality Standards (NAAQS) for ozone.

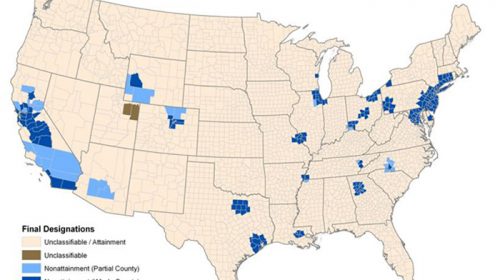

While any of these changes could be significant to the cement industry, the most important is the impending reduction in the ozone standard. It is the third leg of the “cement apocalypse” triangle. The reduction of the standard will send many Central Texas counties into non-attainment, as shown on the accompanying maps prepared by Houston-based Element Markets, a leading broker of offsets for nitrogen oxides (NOx) and volatile organic compounds (VOCs), the precursors that form ozone or smog. There are other projections by additional experts and agencies, but these maps depict the risks to the cement industry.

The potential impact on the cement industry is significant because, once a county is designated non-attainment for ozone, any significant increase in NOx or VOC emissions must be offset by corresponding or even greater reductions. Offsetting can be accomplished by either reducing existing emissions at the same plant or buying emission reduction credits (ERCs) for reductions at other facilities. The purchase and sale of ERCs occurs in an open market and prices are dictated by supply and demand—they are not set by the government. The system flourishes in the Houston-Galveston region where the sales price of VOCs has peaked at more than $300,000 per ton of emissions. The price in Dallas-Fort Worth is much less because the demand is less. The price ERCs may reach in Central Texas is unknown, since the region has narrowly stayed attainment.

Why do we raise this issue now and call the situation an “apocalypse?” The revised ozone standard will arrive at approximately the same time that the demand for cement is expected to exceed supply. EPA is set to issue its final rule in October 2015. Within two years, the EPA must designate non-attainment areas. Texas then has three years to adopt and submit a State Implementation Plan (SIP) implementing offset requirements.

Texas may, and probably will, challenge the rule in court. The rule could be stayed during the appeal process, but if not, could reasonably be expected to be effective in 2018. Therefore, if producers have plans to expand production to take advantage of the market opportunity created by the continued demand for cement, they should consider acting promptly before the new ozone standard is in effect. Alternatively, they could identify possible emission reductions at their facility or other sources in Central Texas that could reduce emissions, and from which they could purchase offsets if/when needed. Producers should consider whether it is worth the investment risk to sign option contracts to tie up those offsets before the price gets either too steep or, worse yet, there are no offsets to buy because their competitors purchased them. The other option is to bet that the more stringent ozone is overturned.

| Ozone nonattainment areas under 2008 standard (75 ppb) |

Paul Gosselink chairs and Jeff Reed is an associate in the Air & Waste Practice Group of Lloyd Gosselink Law Firm, Austin, Texas. They are available to discuss the complexities of the EPA ozone standard at 512/322-5800.