The latest Engineering and Construction Cost Index (ECCI) from El Segundo, Calif.-based IHS Inc. finds cement and concrete markets well supplied nationally, but with pockets of tightness developing—none more so than along the Gulf Coast, where delivery issues and labor constraints are driving price increases.

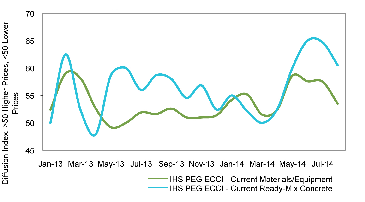

ECCI MATERIALS/EQUIPMENT VS. ECCI READY-MIX CONCRETE |

The Engineering and Construction Cost Index is based on data IHS independently obtains and compiles from Procurement Executive Group participants. The headline index tracks industry-specific trends and variations, identifying market-turning points for key projects, and is intended to act as a leading indicator for wage and material inflation. Each survey response is weighted equally for every $2 billion in spending in North America.Respondents are asked whether material and equipment prices or regional subcontractor rates—either actual paid or company-informed transactions—during a given month were higher, lower or the same as the prior month. They are then asked for their six-month pricing expectations among these same subcategories. The results are compiled into diffusion indexes, in which readings above or below 50 represent upward and downward pricing strength, respectively. |

“The cement and ready-mix industries continue to struggle with fallout from the Great Recession and collapse in construction activity in 2008 and 2009,” says IHS Pricing and Purchasing Analyst Charles McCarren. “In most markets, these industries are keeping up with demand, which remains subpar. However, in the Gulf Coast many producers have a tough time keeping pace with swelling demand.

“Utilization rates in Texas and other Gulf states remain among the highest in the nation. Although we expect a supply response to eventually relieve some of the pressure, it would not be unreasonable to see [cement and ready mixed concrete] prices there to continue escalating in the single digits over the next year, or almost twice the national average.”

IHS prepares the ECCI from surveys of its Procurement Executives Group. With a 50 percent baseline, construction costs rose for the 31st consecutive month in August, to 53.0 percent—softer than the July reading, but still in positive territory. The ECCI materials/equipment component eased to 53.5 percent, down 4 percent from the July reading. In August, six of the 12 materials and equipment category components showed higher prices; of the remaining components, however, five registered neutral prices relative to July. Additional findings from the latest survey can be obtained at www.ihs.com/ecci.